It’s Not Too Much To Ask

Why are we such a bunch of economic peasants?

I’ve been thinking a lot about my relationship to work and money lately.

In my professional life, I’ve put my prices up by a lot because my marketing consultant told me that I looked too cheap for what I actually deliver.

The old ‘neoclassical theory of value’ vs my old fashioned ‘cost plus profit’.

So I put them up. Want to know what happened?

The big corporate clients I tend to do work with haven’t batted an eyelid.

Meanwhile, am I adding to inflation?

It’s not my job to solve that. If I can’t land the work because I’m not seen as credible, then how does that help anyone? Also, I’m eventually going to get outperformed because I won’t have the surplus capital to invest in my business, equipment, training etc. And since innovation is about capitalism’s only saving grace, this Stockholm syndrome capitalist cannot play by rules that no one else is playing.

And it got me thinking - asking for more from our current system really isn’t too much to ask.

Maybe actually we should be asking for less.

Less stress, uncertainty and time wasted on accumulation.

Because, we’re all expected to provide the market with value - enough to provide for our longer lives (regardless that for manual work, evolution only provides our joints with about 40 good years), the ability of our children to get a foot on the property ladder at eye-watering prices, and the care of our parents plus any mishaps or misfortune that might come our way, often through no fault of our own.

We’re also expected to personally absorb massive risk every few years, as the economic rug gets pulled from under the livelihoods we’ve invested in - an investment that may or may not be quietly turned into a free app that harvests our data and that nobody asked for. But you should have planned for that possibility and navigated yourself magically to some other area of the economy that isn’t also going to be disrupted in the next three months…

Individual responsibility for system problems is more than a bit cheeky when expertise is what you have to sell to get a meal ticket and expertise takes time to build up.

You used to be a voice artist but AI has sampled enough voices like yours from the work you’ve done to automate your talent? Why not retrain as a coder? Oh wait…

The invisible hand of the market is not so much lifting all boats anymore as threatening to throttle us by dragging too much of the good things of life into its clutches.

But it also has implications about the contradictory nature of money and value at the heart of the current orthodoxy. In practice, neoclassical economists treat public money as though it comes from a limited pot - even though their models often sidestep money entirely. It’s a bizarre bit of mental gymnastics, as usual modelled on nothing more real than a vaguely anecdotal idea of how humans behave individually.

Anyone can claim as much as they’re worth. But at the same time, it insists the money supply - and therefore public spending - must be tightly constrained somehow. It’s a recipe for crippling inequality.

Because if value is infinite, but money is limited, then the only logical outcome is that those best positioned to extract value will accumulate more and more - and everyone else must be left behind til some are destitute.

There is no other logical outcome. It’s a deliberate economic version of musical chairs with very high stakes.

Not because they’re lazy.

Not because they lack discipline or talent.

But because the system has already decided some must lose everything in order to accommodate abundance somewhere in the system. Hopefully you’re fast and talented enough not to be the one left without a chair.

Business and lifestyle writers go on endlessly about low self-esteem and self-sabotage - as if the problem is only personal.

What happens to a society that has such low self-esteem that it can’t even imagine asking for more?

Fuck meritocratic fairness. It was always bollocks. Michael Young, the originator of the term wrote The Rise of the Meritocracy in 1958 as a satire but by the time of Tony Blair, it was some cast iron law of nature.

I want the abundance that’s in the brochure. For everyone.

I’m not talking about a stupid McMansion each or an Aston Martin in every driveway. Whatever floats your boat for feeling superior but you shouldn’t be able to extract away the basics from others no matter how hard you adhere to workism.

What I mean, is abundance in the time and choices sense. That’s where we get interesting lives and innovative, creative people that make it all worthwhile!

And I don’t think it’s too much to ask anymore. Look around. Do you think the problem is an inability to make stuff? The limit might be the planet but we’ve long since passed the ability to provide enough calories for everyone, for example.

Human beings need somewhere between 1800 and 2100 ish calories a day on average (differs between men and women). How many calories per person do you think we produce on average? You’d think with the food poverty of nearly a billion living below this basic human need that we must only produce 1000 to 1500 calories a day and the rich are hoarding loads they don’t eat.

You might be surprised to learn that our remarkable industrialised food system produces enough for around 5500 calories per person with a fraction of the labour that was required 200 years ago. Near automation of the basics of life has a real life example: Industrial farming.

It’s not to say today’s farmers don’t work long hours, but simply that if we went back to the Britain of 1825 and divvied up the work that needed doing using todays tools, we’d be living the life of Riley and working about an hour a week to achieve the same living standards.

Of course that’s simplistic - you’d need all the people working in the industrial sectors that provide the farming machinery for a start, but the time freedom would be very real.

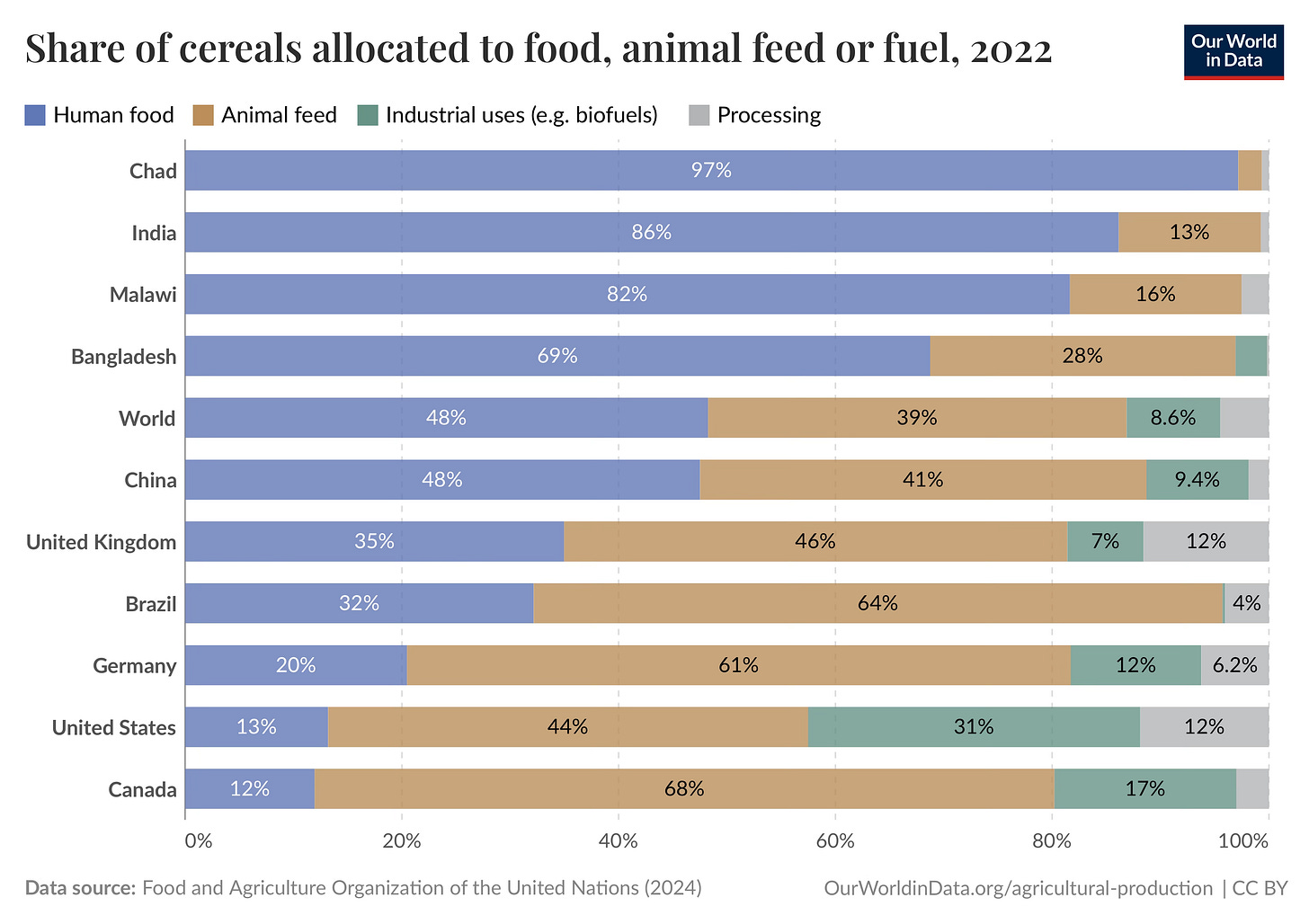

As an example of why that that remarkable innovation still doesn’t provide enough today, see the example of cereals below. Only 48% of the calories go to humans (see the ‘World’ bar). The rest goes to feeding animals and vehicles - yes we’re feeding cars with calories before humans.

So it’s not a question of greedy, nasty people stuffing their faces with foie gras at the expense of Bangladeshis, so much as misaligned economic priorities at the highest level.

For more like that check out Hannah Ritchie’s Not the End of the World

Culturally speaking, are we so afraid of some imagined economic overlord - the Budget God, the Market Judge - that we dare not speak the unspeakable?

“Please, sir, I want some more.”

If you’re unfamiliar with the guerrilla war that has been going on in the field of economics over the last decade, let me bring you up to date (with apologies to those who have heard me bang on about this from time to time over the years):

MMT or Modern Monetary Theory has been both celebrated and vilified because the implications of its conclusions make a mockery of the ‘fiscal rules’ that are holding back much needed public investment.

Celebrated because traditional lefties can point to it and say - ‘look , whatever we can imagine, we can afford’ to borrow from Keynes. That the state is not beholden to private finance for revenue.

Vilified because traditional conservatives and libertarians want to keep up the game of charades where the state is beholden to private finance in the same way that health care is ‘paid for’ like a whip round at the local pub.

I’ve written about this over the years - and I don’t think MMT is the answer to everything - but I’m amazed at the resistance to a change in the orthodoxy across the political spectrum. It’s the equivalent of challenging some people’s religion and clearly, their worldview.

But facts are facts. As sure as the earth obits the sun, money has no automatic reason to be in fixed supply. The gold standard was an attempt to make it so, but it’s a manmade constraint that restricted the US colonies and eventually the global economy as we discovered during the Great Depression.

MMT has flaws1 but shows unequivocally2 that there is no such thing as a fixed “pot” of money. In fact, believing that ‘must be so’ these days is like believing that a course of leeches will fix your broken arm.

Turns out you can just do things like the tech bros are fond of saying. But, you know, democratically and stuff.

If you feel any resistance to that statement, welcome to how threatened the clergy must have felt when Copernicus showed up with his wild heliocentric model in 1543.

You mean we’ve based our entire moralistic crowd control model on a theory of universal centrality that is complete bullshit? Sure, we’ll just relinquish all our power and status right now.

- Said nobody Catholic ever in 1543

The implications of this observation are only now hitting the mainstream (albeit someone needs to tell Rachel Reeves. Maybe that’s why she was crying3 bless ‘er I would be too).

Governments that issue their own currency don’t need to “find” money before they spend - they spend it into existence. The real constraint isn’t money, it’s resources: labour, materials, skills, and time. Yada yada - I’m almost bored of saying it but maybe that’s what we need. A lot of us to be bored of saying it til it sinks in. That we are not financially constrained. We are morally and politically constrained.

So what creates more fiscal space? Productivity and innovation.

If we (for instance) train more doctors and teachers in the public sector – and pay them better – while the private sector needs fewer bankers because financial services have been automated, then we’ve freed up real resources (like skilled labour) to be redirected and we might still be able to have those financial services as well, anyway.

That doesn’t mean we printed more money to fill a bigger pot. There’s no pot! It means we changed the shape of the economy democratically without asking the financial sector for permission. The public sector expanded its footprint where there was space to do so, without pushing us into inflation – because the productive capacity was there.

Lesson: The limit is not money. It’s what we can do with what we have – and how we choose to organise it..

Unlike the traditional left I see a mixed economy as an unvarnished good and that public overreach can be very much a bad thing.

But at the moment in the US and UK in particular we have a culture that is allowing massive private overreach through an obsession with some number on a spreadsheet instead of an obsession with real world outcomes and long term investment.

Stop issuing bonds if they no longer serve a monetary or regulatory purpose. Let existing ones mature and fund spending directly, as currency issuers can. The money that isn’t taxed back is the money in the private economy that we think is finite (in combination with the credit that banks issue when they create loans).

But instead, here we are, the economic equivalent of Oliver Twist, not even bothering to hold up our bowl in the workhouse for fear of being shamed and scolded for daring to ask for more than this.

At least Oliver Twist had the courage and self-esteem to ask. What we have instead is more and more capacity for self-flagellation and timidity.

When the AI stock bubble goes pop and everyone is scrambling about for the next train leaving town, maybe then we’ll realise that spending money into existence is actually useful again, just as those house cat libertarians decided during the pandemic and after the SVB meltdown.

Meanwhile MMT is ok if Donald Trump is ‘doing’ it.4

This is pinched from the Observer’s newsletter this morning:

Donald Trump’s signature policy bill is edging towards the finish line. After narrowly passing the Senate, it is back before the House and could be signed into law before the 4 July fireworks.

So what? It is essentially a tax break that redistributes money from the poorest Americans to the richest. The $4.5 trillion lost in receipts will be offset by

stripping $1.1 trillion from healthcare spending;

cutting federal food assistance by $285 billion; and

treating the debt ceiling as nothing more than a mild inconvenience.

When asking for a return to a mixed economy becomes a signal of being some sort of radical and evil fascist / commie / dreamer (I’ve been called all of the above) instead of a boring left or right of centre centrist, you know the world has lost the plot.

Radical is how that it might feel to reclaim some of the public space for democracy, but it’s not really much to ask.

And making it so that MMT isn’t used as a gravy train to spend on loading up the already loaded, really isn’t too much to ask.

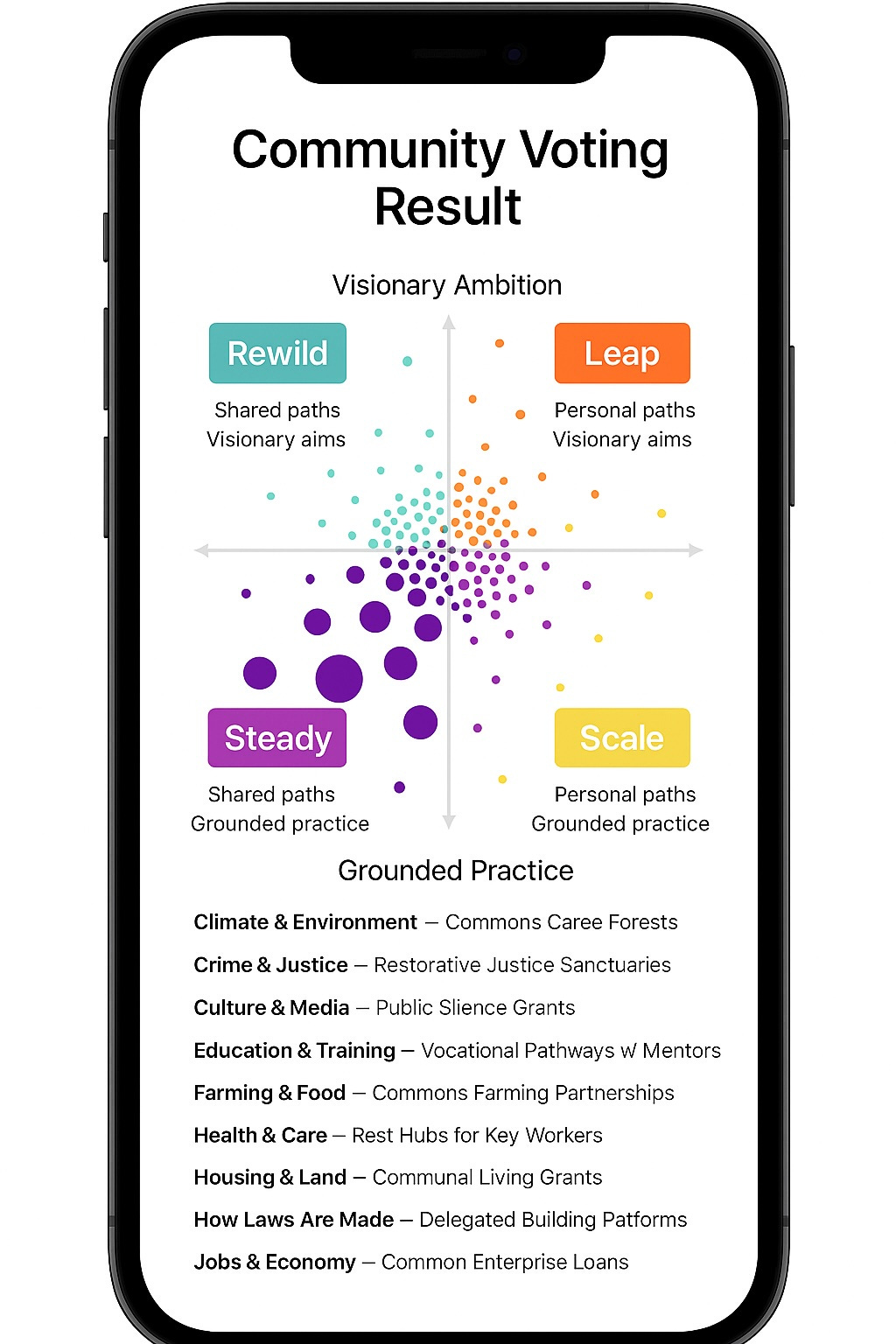

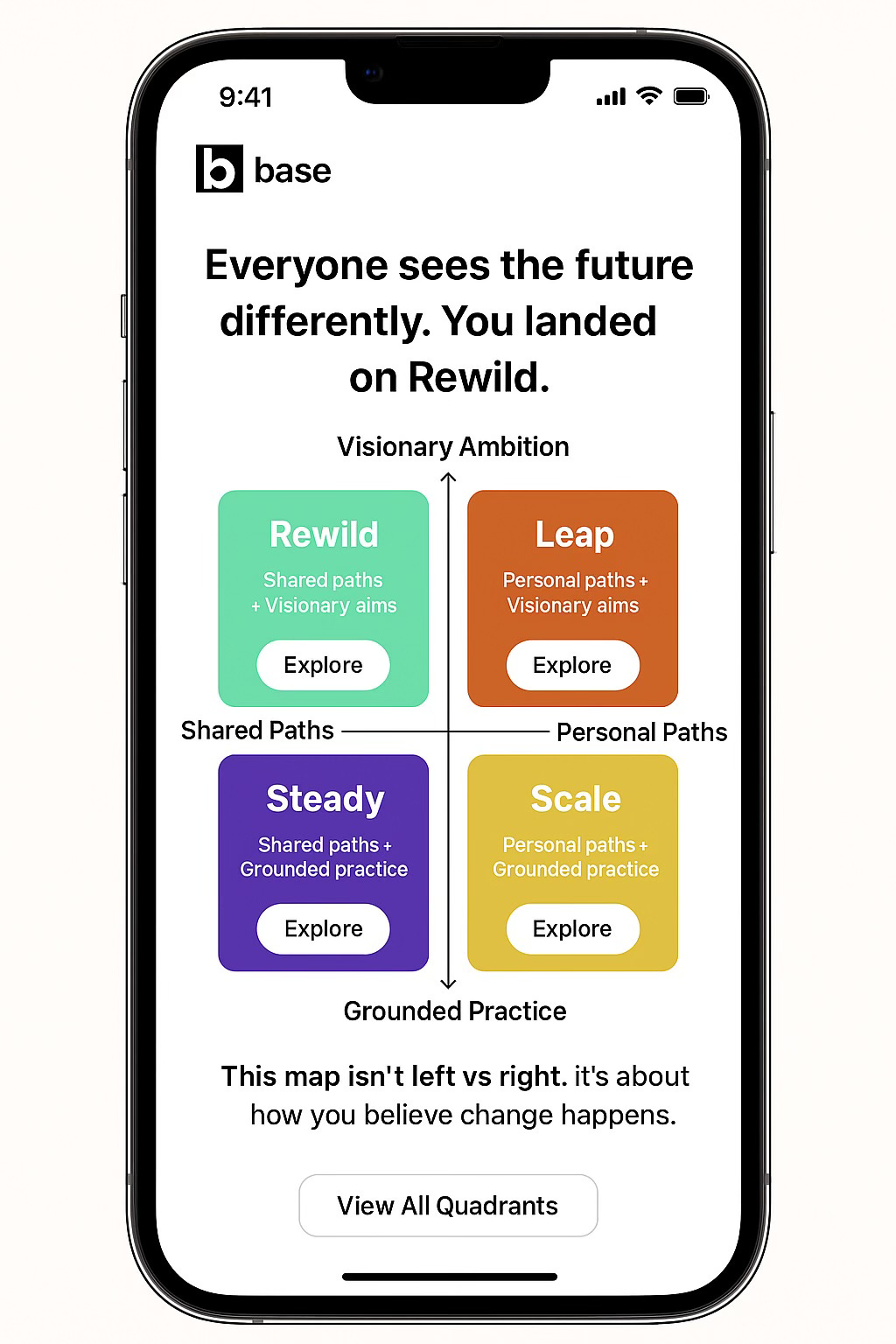

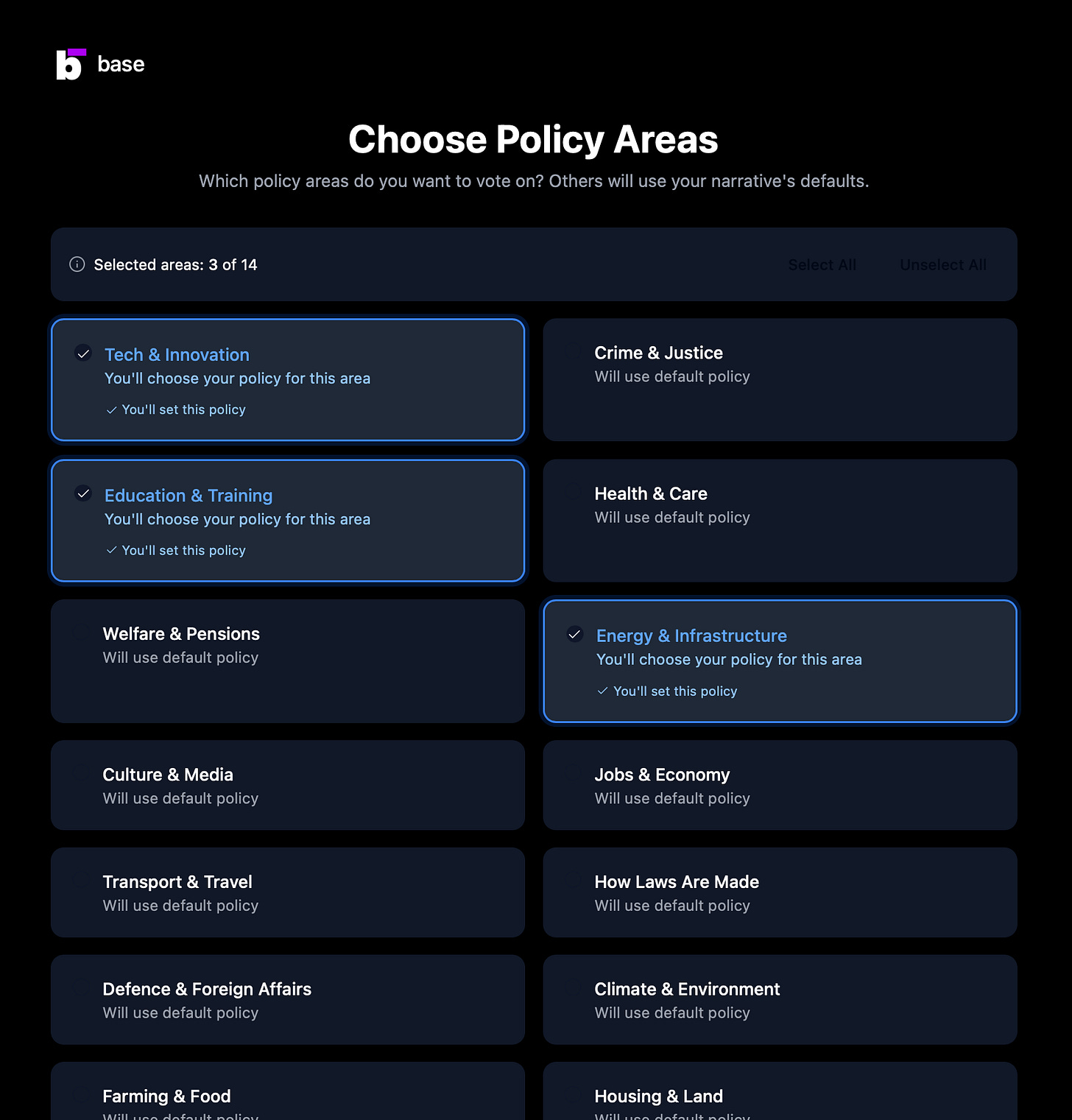

Btw I’m still working on this prototype for the demos of a digitally native democratic economy and when I’m ready to share it, I’m going to need some help in the beta to test it and to help me kick it around (I have four brilliant and generous volunteers currently). Because when it’s ready for prime time, it needs to be what a democratic network state might look like. It doesn’t need to be the answer. It needs to catalyse thinking.

What’s slowing me down isn’t so much the conceptual but the technical challenge of the prototype but I’m getting there!

Meanwhile here’s a teaser:

If you want to be a beta tester I’d love to hear from you.

Footnotes:

https://www.bbc.co.uk/news/articles/cn0qr9wlpnqo

This is where I get scolded by MMTers for not sticking to the talking points. ‘You don’t do MMT, it’s just way of seeing mixed/fiat economies’ etc. Do I sound jaded? Maybe it’s the English heatwave getting to me.

I like your tendency to question ideas.

The answer to your title question is...

1) because we don't analyze on the conceptual/paradigmatic level

2) because new paradigms are permanent progressive solutions and yet in the post enchantment/Enlightenment world the paradigm for intellectual inquiry has increasingly become the monopoly concept of Science Only instead of Wisdom which is the intellectual impulse and discipline of the integratiion of opposites and so we tend to get caught up in analyzing problems instead of pursuing solutions

3) hence brilliant people like Warren Mosler and Steve Keen can correctly identify the way money is created (accounting) and yet can't imagine applying its equal debits and credits tool most efficaciously at retail sale (because its the single universally participated in and hence macro-economic point in the entire economic process) to reduce the price at retail sale by crediting the consumer with a 50% Discount thus doubling everyone's purchasing power and yet with the Rebate/equal debit aspect of the policy the merchant gets their full price so no moral hazard and finally

4) the monopoly paradigm CONCEPT for the creation and distribution of new money of Debt ONLY that the palace or the private banks have wielded since day one of human civilization is broken up by integrating its opposite concept (the impulse and process of Wisdom) of Monetary Gifting (aspect of the natural philosophical concept of grace) into the Debt Only system and so neo-classicalism is transformed into Wisdomics-Gracenomics.

>> Governments that issue their own currency don’t need to “find” money before they spend - they spend it into existence.

Dude, no, just no. You haven't lived through when this shit happens. It basically always ends up with everyone who doesn't have hard assets going broke and the rest going richer. And government overreaching. Even if the government tries to put it into "productive" things.