How Fiat Money Saved the American Colonies

The fast growing colonies couldn't grow with a fixed money supply.

I stumbled across an explainer published by the Federal Reserve Bank of Cleveland that sheds light on the story of money in the early colonies. It’s a historical reminder of why modern fiat economies exist at all and how they solve a different problem to the store of value problem that hard currencies evolved to address.

Remember - economic growth (that wasn’t based on invading somewhere and plundering gold / resources) is a modern phenomenon ushered in by the Industrial Revolution.

But first - a quick personal anecdote to set the scene:

I remember the time I was first introduced to the survival economy. I was working in retail and my manager and I got chatting at an after-work drinks party.

We got talking about future plans and the possibility of starting a family.

“I can’t wait til you stop renting and get a mortgage,” he said. “because then you’ll need this job even more".

We laughed awkwardly.

He probably thought he would appear honest and transparent in a kind of ‘ain’t that the truth’ kind of way. To me, it was just odd.

And it stayed with me.

I couldn’t put my finger on it at the time but I was having my first brush with the cultural phenomenon of the survival economy. It’s not capitalism but a cultural bit of capitalist baggage that expects to exploit our need to survive in order to get us to do things we would not otherwise do.

It was kind of received wisdom that no one was really doing what they wanted to do. So why was I there? Well, like everyone else, I harboured another potential life for myself but the risk of jumping into it was just too great at the time. It’s not that anyone consciously feels the bitter tang of survival anxiety every time they think of changing direction. We’ve internalised the acceptance of it to such a degree, I think we hardly notice it.

We’re all in the survival economy together and while some of us might hear the wolf closer to the door than others, it’s assumed the survival economy trundles on.

So why am I telling you this?

Because right now - as of May 2023 at time of writing - the plan (led by the US Federal Reserve) is to pull whatever levers it can to increase unemployment, which (in theory) will stop people from spending and generally hold everyone’s feet closer to the fires of the survival economy. All in the name of taming inflation. It’s called NAIRU if you’re interested but the main thing to know is that’s it’s complete bullshit.

And why is it seen as a reasonable thing to use unemployment to tame inflation? Because we’ve made it impossible for politicians to use taxation as a means of curbing inflation. There are even economists who continue to sell the idea that taxation can’t bring down inflation, who at the same time will keep a straight face while they tell you governments are spending money they don’t have. In a fiat system, spending is the only way money gets into the economy and taxation is the only way it gets back out. Any other effect on inflation is slippery to say the least.

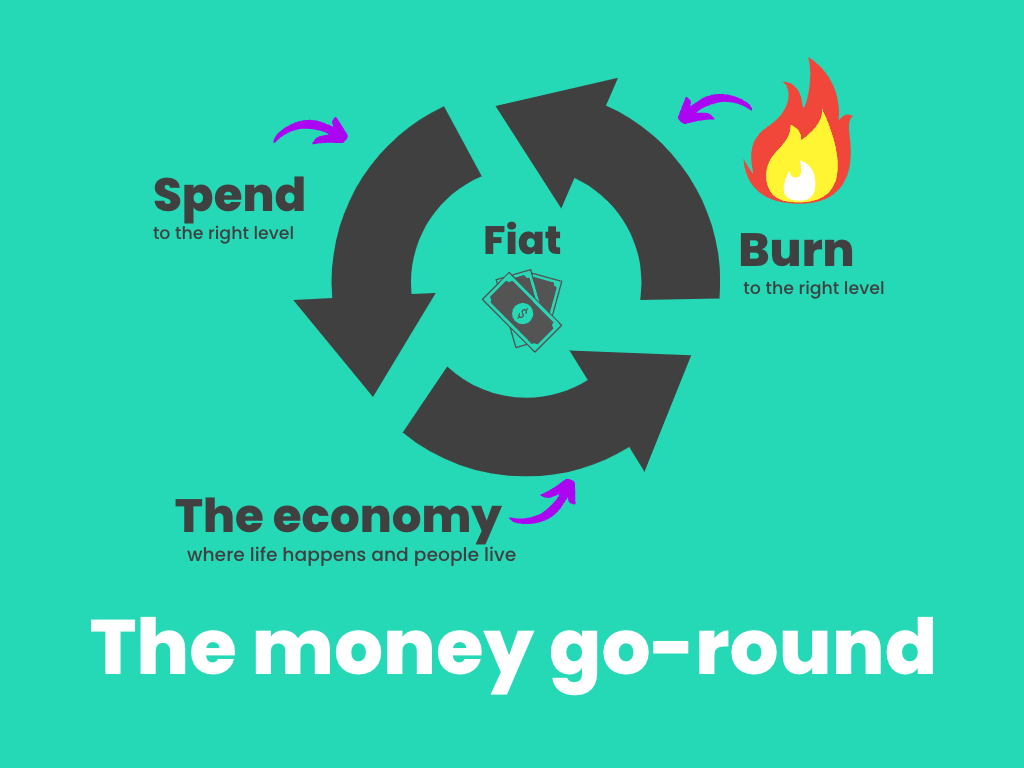

So if your complaint is there’s too much ‘money printing’ (it’s just money spending) how can you argue against reversing it? We need to burn some of that money, it’s as simple as that.

Governments issue money as part of fiscal policies and then, to keep inflation at a set level, burn money through taxes. But it’s possible they don’t burn enough. If the term ‘burn’ sounds a bit too casual when it comes to money, then, good news! I’m not making it up:

Now - to that historical explainer published by the Federal Reserve Bank of Cleveland, “American colonies first turned to fiat paper money in the late seventeenth century. These paper currencies eventually came to make up the lion’s share of currency in colonial America—estimated between 50 and 75 per cent of the total, with specie (physical assets like gold or silver) making up nearly all of the rest…the governments used any specie that they received in tax payments to retire and then burn the notes.”

In short, America was a big new country and there wasn’t enough gold to go around when you’re trying to develop an economy. In order to keep the currency stable, they agreed to limit the printing of promissory notes but also use the imposition of taxes as a way to retire the notes and print more as needed. Most importantly for our purposes, the process was a question of minting and burning in a responsible and deliberate way in order to avoid inflation. The explainer continues:

“Following its successful use of fiat money in 1690, Massachusetts made multiple issues of paper currency to finance its involvement in Queen Anne’s War (1702-1713). Over the next 10 years, the stock of paper currency in Massachusetts increased by an incredible 39 per cent per year (compound annual rate). The other New England colonies also began issuing paper currencies to meet wartime and other expenses. Between 1703 and 1713, the quantity of paper currency circulating in New England had increased at least 34-fold.

This sharp increase in the stock of paper currency, however, did not seem to have a correspondingly large inflationary kick. The price of silver in Boston, which measures the depreciation of the Massachusetts pound and proxies for inflation in New England, rose only from 7 shillings to 8½ shillings over the course of the war. According to historian Leslie Brock, this modest rise probably reflected a premium that merchants were willing to pay to acquire specie, rather than an underlying inflation. Specie, always in short supply, had begun to grow even scarcer during the war.”

This process of minting and then burning via tax stops people from using the currency to bid up prices without needing to control the means of production. If the economy keeps making more than enough stuff through more and better jam jar machines, then all the new money could just get soaked up without prices rising. But there’s always a risk of hyperinflation (or massive deflation) when the levers of interest rates, private debt creation and taxes take so long to have their intended effect.

So when I say burn, baby, burn, it’s got pedigree. But here’s a couple of points to make about taxation.

First of all, I don’t necessarily mean higher taxes though that may be required. I mean tax reform to make sure that the tax base is significantly enlarged to include everything.

Because what is keeping everyone in the survival economy is not simply the lack of redistribution from the wealthy (who generally avoid income tax by dint of not being employed as such). It’s the fact that income tax of 25 to 30-odd per cent for everyone is absolutely rinsing income earners because they are shouldering the bulk of the tax burning so other parts of the economy can avoid tax (in percentage terms) and still spend as much as it likes even while inflation is raging.

That’s the scandal. And so we even have breathless headlines from WSJ this week where the editorial accepted that inflation might actually be down to corporate profits after all.

https://www.wsj.com/articles/why-is-inflation-so-sticky-it-could-be-corporate-profits-b78d90b7?page=1

Secondly, did I mention it’s a scandal?

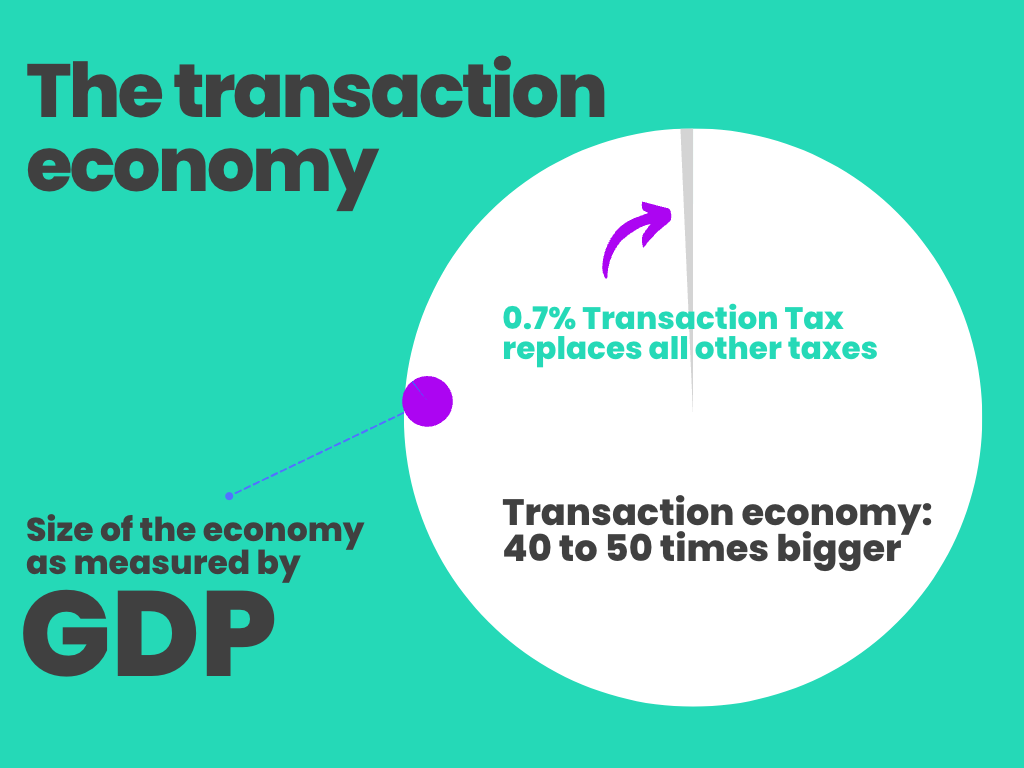

More than ever we live in a digital money world where transactions form a much better picture of what is measurably valuable in an economy. There’s no part of the economy that can function without a transfer of capital in some way.

Therefore, why not just tax the transactions to keep the currency from inflating? A less than 1% Automated Transaction Tax would expand the tax base to include everything in the economy making the base 40 to 50 times bigger, including share trading, capital movements to and from tax havens and revenue to large multinationals that currently present their books in Ireland and other low tax countries instead of where the purchases are made.

This makes the burden less for everyone. Unless of course you are paying zero tax currently.

Once it’s possible to tax fairly and evenly across an entire economy at a very low rate for everyone, then it is also possible to manage inflation with very small adjustments in the tax.

This would allow working people to more easily keep themselves at arms length from the surval economy, to keep our economies at or near full employment and still keep inflation manageable. It may well also need more democratic oversight so the current political establishment doesn’t spend more than the manifesto mandate as well, but at least that would be the correct use of tax in the 21st century.

If we were living in an APT world, with more disposable income and savings, the conversation with my retail manager would have been very different indeed.

Great work! I think too many get caught up in concerns about the "income" of wealthy people while also admitting that income tax won't capture it. The only way to "capture" the wealth of the superwealthy in any meaningful way would be to tax unrealized gains.

That's a double-edged sword though and would likely backfire badly in the long term. I will have to look further into this automated transaction tax. Other suggestions worth looking into might be an estate tax, or a distributed gains tax....a tax only on dividends and stock buybacks (this is done in Estonia).

Still, if we aim to have a simple tax code (<5 pages) that efficiently generates significant revenue, I still vote for Land Value Tax + Value Added Tax. Both are relatively easy and cheap to administer, extremely difficult to evade, provide stable revenue, do not harmfully distort the economy, and are proportional, if not progressive.